Apartment budget calculator: how much rent can you afford with your income?

Are you wondering how much rent you can afford with your salary? Your rent is probably the biggest item on your monthly budget, and it’s no secret that rents continue to skyrocket. Thinking of living in Los Angeles, San Francicso, or New York? Unfortunately, so is everyone else. Here’s what to consider when calculating your apartment budget before you start hitting Craiglist and Zillow.

Apartment budget calculator basics

The most basic advice you will hear is to allot 30% of your after-tax salary to rent. Another way to calculate your maximum monthly rent that gives exactly the same answer is to divide your annual after-tax salary by 40. That’s nice, but how do you figure out your after-tax salary?

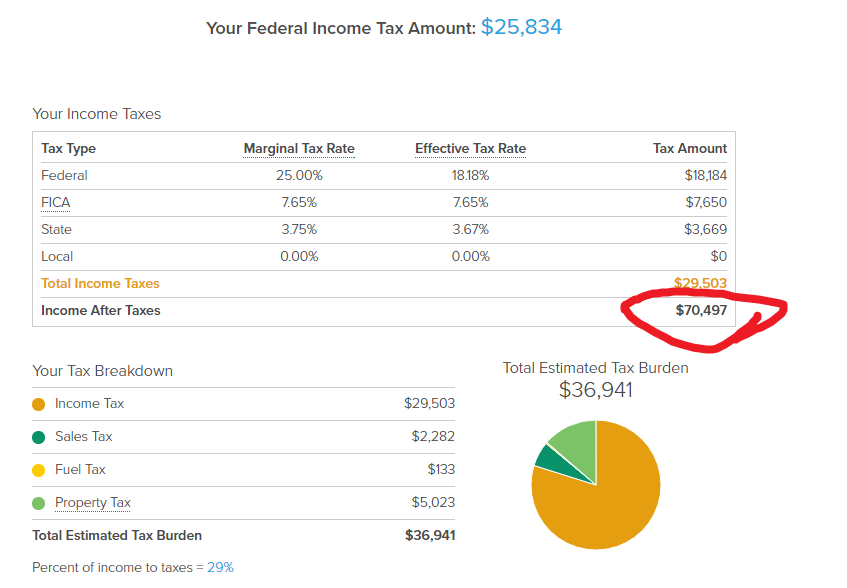

Your taxes change a lot based on your city and state of residence. There is a great calculator at SmartAsset that lets you enter your salary and location to find your after-tax take home pay. As an example, if we enter $100,000 as our yearly salary living in Chicago, here’s what we see:

I’ve circled the final number we want in red. We see that we would pay a total of $29,503 in federal and state taxes, leaving us with $70,497. Dividing this by 40, we are left with $1762 as our maximum monthly rent. This isn’t the end, though. You might want to go lower and higher for different reasons. Keep reading to find out why.

The hidden costs and benefits of your apartment’s rent

In major cities, 30% might not be a realistic option. The first thing you should check on rent is whether utilities and heating are included. Heating bills can easily reach a hundred a month in a poorly insulated apartment during winter. Electricity is usually not included, but if so, realize that air conditioning in the summer is also another major expense. An internet package like shared Wi-Fi is also worth about $50 a month after all fees. Your total utilities and service bills could add another 10% to your apartment budget, so if some of these are included, it makes sense to push your maximum rent up to around 40% of your after-tax salary.

Commuting and transportation is the other major concern. You can rent outside of the city, but then you may have to commute by car or train every day to work. Can you survive without a car in the city for your basic groceries and needs? What about on the city outskirts? If renting closer to the city means you do not need a car, you are saving on auto insurance, gas, maintenance, parking fees, and of course the cost of the car itself.

Don’t discount the value of time. Does your apartment’s location give you a 5 minute commute to work? You could be saving 1 hour each way, which works out to 20 hours a month. What is your time worth? Your apartment’s location could also save your monthly budget in different ways. Are you right next to a grocery store? You might find it easier to buy groceries and cook at home if doing so is convenient. Cooking at home can lead to tremendous savings compared to eating out every day, not to mention the health benefits. The 30% rule is a just a guide, so figure out what benefits and costs are actually behind each apartment besides just the rent.

Balancing enjoyment and financial sense

No one says you have to spend 30% of your income on your apartment budget. You could get roommates, spend less, and save money instead. Or getting the most out of your early 20s, YOLO-style, maybe important to you. Then, living near the happening places might be worth paying extra rent. It’s all up to you and what makes practical sense for your lifestyle and interests. This guide is just a starting point for you to figure out what really matters to you when setting your apartment budget.